|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

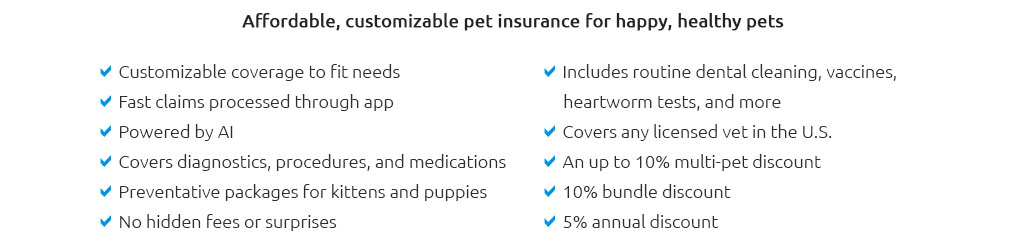

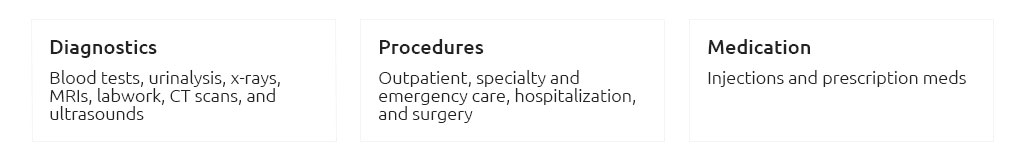

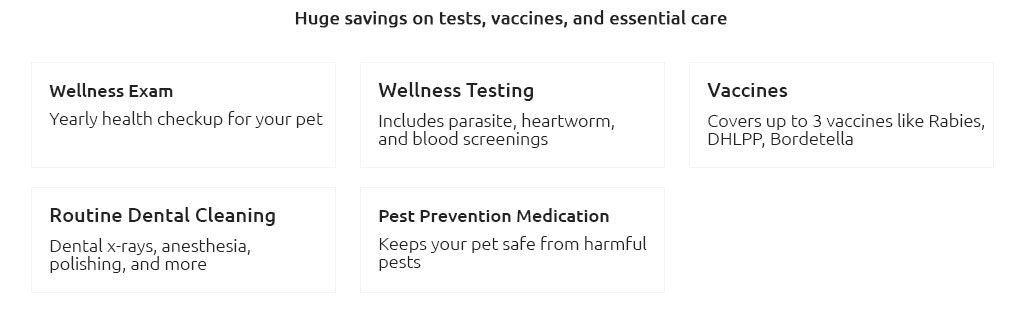

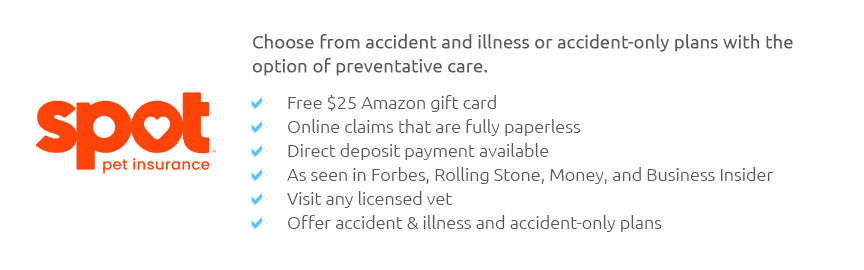

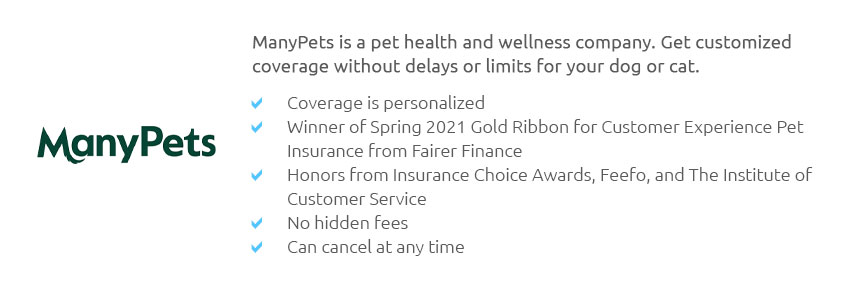

pet health insurance company guide for beginnersWhat it is and why it mattersA pet health insurance company helps you manage surprise vet bills by reimbursing covered treatments. Instead of stressing over costs, you file a claim after care and get money back, depending on your plan. For first-time buyers, understanding terms like deductible, reimbursement rate, and annual limit makes choices far less confusing. How a policy worksPolicies generally exclude pre-existing conditions and may have waiting periods before illness or accident coverage begins. Most plans let you visit any licensed vet, submit invoices, and receive a percentage back. Optional riders can add wellness or dental, but they raise premiums, so compare what you truly need. Key factors to compare

Before enrolling, get multiple quotes for the same pet and coverage, and ask your vet which insurers process claims smoothly. Start with a modest plan, then adjust limits as your budget and your pet’s age or risks change. https://www.usnews.com/insurance/pet-insurance

Pet insurance provides coverage to help with costs related to unexpected pet injuries and illnesses. Routine care, like vaccinations and annual exams, is ... https://www.forbes.com/advisor/pet-insurance/best-pet-insurance/

It does not cover illness-related vet expenses. Pet wellness plans for routine care. This is typically an add-on policy that covers routine vet expenses like ... https://www.healthypawspetinsurance.com/

The top-rated cat insurance & dog insurance plans cover accidents, illnesses, cancer, emergency care, genetic and hereditary conditions, breed-specific ...

|